Self-employment tax rate remains the same for 2025; it is 15.3%. The 15.3% taxes are for Medicare and Social Security taxes. The maximum earning subject to Social Security taxes for 2025 is $176,100.

Compensation earned above this amount is only subject to the Medicare tax of 2.9%, there is no Social Security taxes above $176,100 for this year.

Self-employment taxes affect ordained ministers as they are considered self-employed even if they are an employee of a church or ministry.

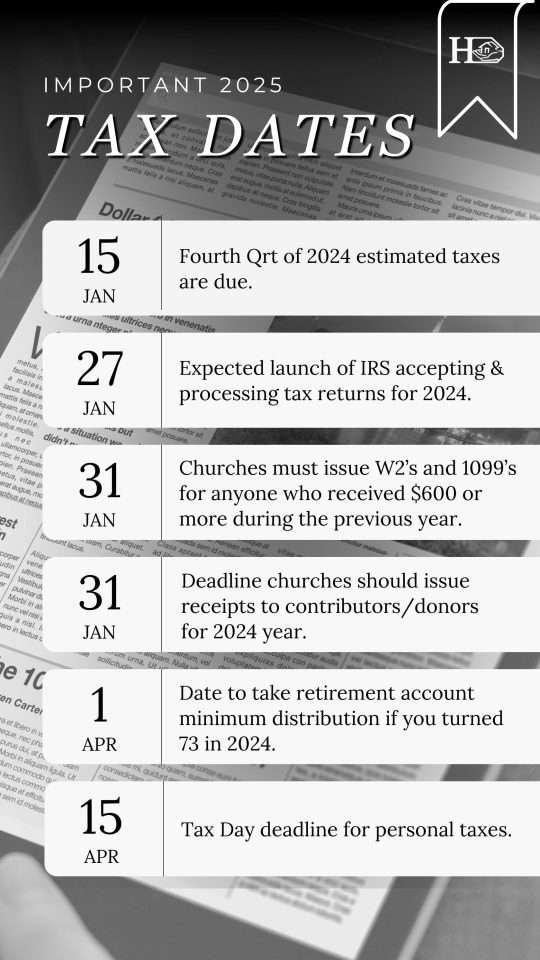

Important 2025 Tax Dates:

- Jan 15 – Fourth Qrt of 2024 estimated taxes are due

- Jan 27 – Expected launch of IRS accepting & processing tax returns for 2024

- Jan 31 – Churches must issue W2’s and 1099’s for anyone who received $600 or more during the previous year

- Jan 31 – Deadline churches should issue receipts to contributors/donors for 2024 year

- Apr 1 – Date to take retirement account minimum distribution if you turned 73 in 2024

- Apr 15 – Tax Day deadline for personal taxes

If you’re dizzy just reading this, we understand. Taxes can be overwhelming and our team is here to help you as you pursue your calling, we’re just a quick call away. Don’t torture yourself.

Dan Peterson, Founder

253-459-9553